- Analítica

- Disposição do mercado

US dollar bullish bets fall on disappointing US economy performance

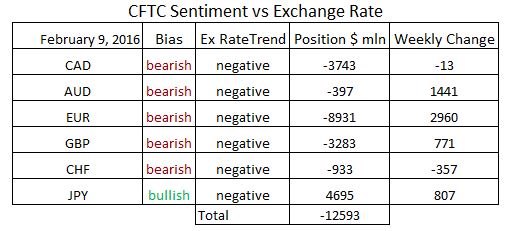

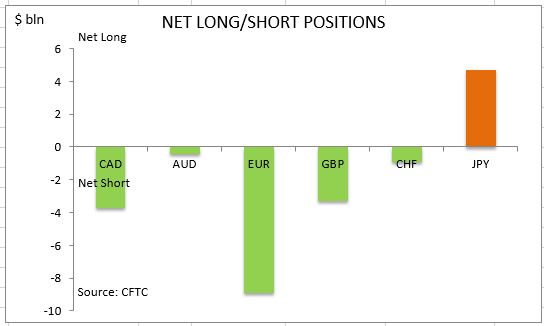

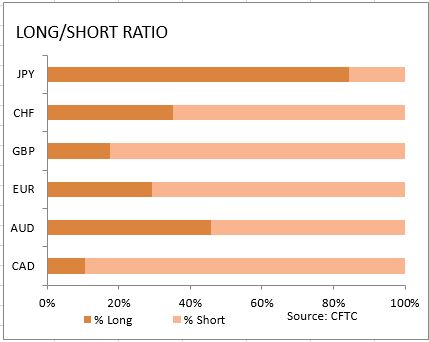

US dollar net long position fell to $12.6 billion from $18.2 billion against the major currencies in the previous week, as the report of the Commodity Futures Trading Commission (CFTC) covering data up to February 9 shows. Economic reports during the week confirmed that the US economic growth is slowing. The services sector growth was weaker than expected with ISM Non-Manufacturing PMI falling to 53.5 in January from 55.8 in December. Manufacturing activity contraction was indicated by a further fall in Factory Orders in December which exceeded the decline in the previous month: less volatile factory orders excluding transportation fell 0.8% on month compared with 0.7% reduction in November. The jobs report indicated the growth in nonfarm employment also slowed as anticipated, with private payrolls rising by 158 thousand in January instead of expected 183 thousand jobs. On the positive side unemployment fell to 4.9% from 5% and average hourly earnings rose 0.5% in January compared with no change in December. Improving labor market continues to serve as one of the justifications for policy makers’ rising inflationary expectations and shift to contractionary monetary policy. However, the slowing US economic growth, continued slump in commodity prices and turmoil in global stocks markets make it less likely that the Federal Reserve will implement the 100 basis point rate hike announced in December policy statement. Investors cut the bullish bets on US dollar as market participants revised downward the likelihood of further interest rate hikes. As is evident from the Sentiment table, sentiment improved for all major currencies except for the Swiss franc and Canadian dollar. And the yen continues to remain the only major currency held net long against the US dollar.

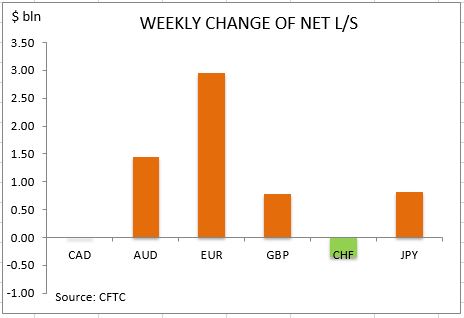

The bearish euro sentiment improved substantially as net short bets narrowed by $2.9bn to $8.9bn. However euro’s share rose to over 70% of long US dollar position. The euro net short position fell as investors increased long positions and covered shorts by 18595 and 5164 contracts respectively. The bullish Japanese yen sentiment intensified on the back of heightened haven demand as the slump in global equities continued. The net long bets in Japanese yen rose by $0.8bn to $4.6bn. Investors reduced the gross longs by 6297 contracts and reduced gross shorts by 12284. Sentiment improved considerably for the British Pound with the net short position narrowing by $0.7bn to $3.2bn. Investors cut both the gross longs and gross shorts.

The bearish sentiment remained essentially unchanged for the Canadian dollar with the net short position widening by $13 million to $3.7bn. Net short bets in Canadian dollar became the second biggest after bearish bets in euro. Investors cut both the gross longs and gross shorts. The sentiment toward the Australian dollar improved dramatically with net short bets narrowing by $1.4bn to $0.39 bn. Investors increased the gross longs and cut the gross shorts. The sentiment continued to deteriorate for the Swiss franc with net short bets rising by $0.3bn to of $0.9bn. Investors cut both the gross longs and gross shorts.

Nova ferramenta analítica exclusiva

Qualquer período- de 1 dia a 1 ano

Todos os grupos- Forex, Ações, Índices, etc.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.

Ultimas previsões

- 18mar2021Líderes de Crescimento e Queda: dólar canadense e iene japonês

Nos últimos 7 dias, os preços do petróleo, dos metais não ferrosos e outras matérias-primas minerais, embora tenham descido, mesmo assim, se mantiveram em um nível elevado. Graças a isso, houve um fortalecimento das moedas dos países de commodities: o dólar canadense, os dólares australiano...

- 10mar2021Líderes de Crescimento e Queda: Dólar canadense e dólar neozelandês

Nos últimos 7 dias, os preços do petróleo continuaram subindo. Devido a isso, houve um fortalecimento das moedas dos países produtores de petróleo: o rublo russo e o dólar canadense. O dólar da Nova Zelândia enfraqueceu após a publicação de indicadores econômicos negativos: ANZ Business Confidence...

- 4mar2021Líderes de Crescimento e Queda: Dólar americano e rand sul-africano

Nos últimos 7 dias, os preços do petróleo continuaram crescendo. Os metais preciosos, incluindo ouro, caíram de preço. Neste contexto, se verificou o aumento das ações petrolíferas, o fortalecimento do rublo russo e o enfraquecimento dos dólares australiano e neozelandês, bem como do rand sul-africano....